How to Find Competitor Websites: A Quick, Actionable Guide

Learn how to find competitor websites using smart search tactics and tools. This concise guide reveals actionable strategies for market analysis.

Finding your competitors used to be as simple as a quick Google search. But that’s old-school thinking. Today, your rivals are everywhere—not just in search results, but scattered across social media, popping up in marketplaces, and even getting top billing in AI-generated answers.

This guide is your modern playbook for digging deep and uncovering all of them, moving past obvious searches to find the hidden threats and untapped opportunities that truly define your market.

Why Your Old Competitor List Is Obsolete

If your competitive analysis still revolves around a handful of keywords, you’re flying blind. The customer journey has fractured into a dozen different paths, and your real competition might not even show up on Google's first page anymore.

The entire game has changed, especially with the rise of AI-powered search. Think about this: recent data shows that only 8% of AI-related queries actually lead to a website click. This means businesses stuck on traditional SEO are likely missing 92% of the customer interactions now happening within generative AI platforms. You can read more about this trend on Vertu.com to see just how significant this shift is.

Expanding Your Search Horizons

A truly comprehensive discovery process isn't just a nice-to-have; it's essential for survival. You have to look beyond the direct keyword competitors to grasp the entire ecosystem you're operating in. This requires a few key shifts in your approach:

- Platform-Specific Discovery: The companies you're up against on Amazon are likely different from your rivals on Google, who are totally different from the brands winning on TikTok. Each platform demands its own unique discovery strategy.

- Problem-First Mindset: Stop searching for companies that look like yours. Instead, start searching for the problems your customers are trying to solve. This is how you find the indirect and alternative solutions that are quietly stealing your market share.

- From Lists to Tiers: The goal isn’t to create a flat list of names. It’s to categorize them into meaningful tiers—direct, indirect, and aspirational. This helps you prioritize where to focus your energy and resources.

Identifying competitors isn’t a one-and-done task. It’s a continuous intelligence-gathering operation. New players emerge and established ones pivot constantly, so an agile discovery process ensures you’re never caught off guard.

A great way to get started is by running a quick market snapshot with a tool like StatsHub.ai. It can deliver an instant analysis of the major players, giving you a solid foundation. From there, you can dive into the more detailed methods we'll cover next to build a complete, nuanced picture of who you’re really up against.

To help you get started, here's a quick look at the core discovery methods we'll be diving into.

Core Methods for Finding Competitor Websites

| Method | Primary Use Case | Example Tools |

|---|---|---|

| Search Engine & SEO Analysis | Identifying rivals who rank for your core keywords and topics. | Semrush, Ahrefs |

| Paid Advertising Intelligence | Uncovering competitors who are bidding on your audience's attention. | Similarweb, SpyFu |

| Social Media Listening | Finding brands that are part of your industry's conversation. | Brandwatch, Hootsuite |

| Marketplace & Review Sites | Discovering direct product or service alternatives. | G2, Capterra, Amazon |

| Content & Audience Overlap | Finding sites that attract the same audience you do, even if indirectly. | SparkToro, Google Analytics |

This table provides a high-level overview, but the real magic is in the details. Now, let’s get into the specifics of how to execute each of these methods effectively.

Uncovering Hidden Rivals with Advanced Search Tactics

Your standard search queries are a decent starting point, but they'll only ever show you the most obvious competitors—the ones everyone already knows about. To get a true sense of the market, you need to dig deeper using the very tools Google gives its power users.

Advanced search operators are essentially commands that let you filter out the noise. They're like a secret language that helps you find rivals who might not be ranking for your main keywords but are definitely stealing slices of your target audience. By combining a few of these, you can start unearthing competitors based on their technology, pricing, or even specific features they offer.

This is how you move from broad discovery to surgical precision, finding competitors flying just under the radar.

Mastering Foundational Search Operators

Before you start stringing operators together, it's worth getting comfortable with what each one does on its own. Think of them as individual tools in your competitive intelligence kit.

Here are a few of the most powerful ones for this kind of research:

related:[domain]: This is your fastest path to finding direct competitors. Pop in a known competitor, likerelated:hubspot.com, and Google will instantly show you who its algorithm sees as similar players—think Marketo, Pardot, and Zoho CRM. It's a fantastic shortcut.site:[domain]: Use this to search inside a single website. It's incredibly handy for seeing how a competitor talks about a specific feature or topic you're interested in.inurl:[keyword]: This one looks for your keyword within a page's URL. It's perfect for finding competitors with dedicated pages for things like "pricing," "integrations," or "case-studies."intitle:[keyword]: This narrows your search to pages that have your keyword in the title tag, a strong signal of the page's main focus. It's a great way to find others targeting the exact same topics you are.- Quotation Marks

"[keyword phrase]": Simple but essential. Putting a phrase in quotes forces an exact match, which is critical for finding specific product names, features, or marketing slogans.

By mastering a handful of search operators, you shift from a passive searcher to an active investigator. You're no longer just asking Google for answers; you're telling it exactly where and how to look, which is the key to uncovering rivals others have missed.

Combining Operators for Strategic Discovery

The real magic happens when you start chaining these commands together. This is where you can build incredibly specific queries that surface competitors based on their business model or content focus. Instead of just searching for something generic like "project management software," you can hunt for rivals who solve a very specific problem for a niche audience.

Let's say you run a SaaS company with project management software that has a killer Zapier integration. A basic search is way too broad. A far more strategic query would be:

intitle:"project management" inurl:integrations "zapier"

This single search string instructs Google to find pages that meet three criteria:

- They have "project management" in the title.

- They include the word "integrations" in the URL.

- They mention the exact phrase "zapier" somewhere on the page.

All of a sudden, you're not sifting through every project management tool out there. You're looking at a hand-picked list of direct competitors who are actively promoting the same key feature you are.

Actionable Examples for Different Industries

The beauty of this method is how flexible it is. You can tailor your queries to fit just about any business model or niche, helping you find the competitors who are most relevant to your strategy.

For an E-commerce Store Selling Ethical Coffee Beans:

- Query:

intitle:"coffee subscription" "fair trade certified" - Why it works: This query finds online stores that aren't just selling coffee but are specifically targeting the "subscription" model and using "fair trade" as a core value proposition. It instantly filters out generic coffee sellers and highlights your true niche competitors.

For a Local HVAC Service in Miami:

- Query:

site:yelp.com "HVAC repair" "Miami" -inurl:ad - Why it works: This query searches exclusively within Yelp for HVAC companies in Miami, but the

-inurl:adoperator cleverly excludes paid ads. What you're left with are the businesses ranking organically on a key local review platform.

Using these advanced tactics, you can move beyond the obvious players and start mapping your competitive landscape with a level of detail that actually informs your strategy. It’s a vital step toward building a complete and truly actionable view of your market.

Using SEO Tools to Map Your True Digital Competition

Manual searching is great for getting a feel for the landscape, but it just doesn't scale. If you want a comprehensive map of your market, you have to move past educated guesses and into systematic, data-driven discovery. This is where professional SEO tools are absolutely essential.

Platforms like Ahrefs, Semrush, and Moz Keyword Explorer are built to dissect the entire search landscape. Instead of you thinking you know who your competitors are, these tools tell you exactly who's fighting for the same digital territory—the same keywords, the same audience, and the same visibility. It's the fastest way I know to find the competitors that actually matter.

Start with Keyword Overlap

The most straightforward method for finding competitors in an SEO tool is to analyze keyword overlap. This metric cuts right to the chase, showing you which domains rank for a significant chunk of the same keywords you do. If a website consistently shows up for the search terms that bring you traffic, they are, by definition, a direct competitor.

Most major platforms have a report called something like "Competing Domains" or "Organic Competitors." It’s simple: you plug in your own domain, and the tool spits out a list of sites that share your keyword footprint. This isn’t a hunch; it’s a data-backed reality check on who is actually vying for your audience's attention in Google.

For instance, a project management software company might run this report and find the usual suspects like Asana and Trello. But they'll almost certainly discover smaller, niche-specific tools that have a surprisingly high keyword overlap, especially for valuable long-tail phrases.

From Raw Data to a Strategic Hit List

That initial export of competing domains? It’s just raw data. The real work is turning that spreadsheet into a strategic asset. You might get a list of hundreds of domains, and I guarantee many of them won't be true competitors.

Your job is to filter this down to the real threats and opportunities. For every domain on that list, you need to ask a few critical questions:

- Do they solve the same core problem? Look past the keywords and at their actual product.

- Are they targeting the same customer? An enterprise-grade tool and a freelancer app might share keywords, but they aren't direct rivals.

- Is their business model similar? A blog or a free tool might rank for your terms but isn't a commercial competitor.

An SEO tool gives you the starting point, not the final answer. Real competitive intelligence comes from layering your own market knowledge on top of the raw data to find the rivals who can actually affect your bottom line.

Once you’ve done your filtering, the next step is to categorize them. I’ve always found it helpful to sort them into tiers:

- Tier 1 (Direct Competitors): Same product, same audience. These are your head-to-head rivals.

- Tier 2 (Indirect Competitors): They solve the same problem but with a different solution, or they target an adjacent audience.

- Tier 3 (Aspirational Competitors): These are the market leaders you look up to. You might not compete with them today, but you can learn a ton from their strategy.

Suddenly, a messy spreadsheet becomes a clear, actionable plan.

Don't Forget Paid Advertising

Your organic competitors are only half the story. You also need to uncover the companies actively paying to get in front of your audience. These are your paid search competitors, and their presence often signals who has the budget and the drive to capture market share.

Tools like SpyFu or the PPC reports inside Semrush and Ahrefs can show you exactly who is bidding on your most valuable keywords. This often reveals competitors who are weak organically but are spending heavily to buy high-intent traffic.

And don't stop at Google. Social ad libraries are a goldmine. The Meta Ad Library, for example, is a free and incredibly powerful tool. You can search by keywords related to your industry and see every single active ad campaign. It's a fantastic way to find companies using social media to reach customers before they even think to search. Digging into their ad copy and landing pages gives you a direct look into their messaging, offers, and strategy.

Finding Competitors Beyond Their Main Website

Your go-to SEO tools are brilliant for mapping out the search landscape, but they all share a common blind spot. They’re fantastic at finding competitors with a strong website presence, but what about the rivals who don't? Some of your toughest opponents might be thriving inside walled gardens, capturing customers long before they ever type a query into Google.

To get a complete picture of how to find competitor websites and their digital equivalents, you have to look beyond traditional search. Your competition isn't just a list of domains; it's a web of players operating across marketplaces, social platforms, and tight-knit communities. If you ignore these channels, you're only seeing a fraction of the battlefield.

Investigate Niche Marketplaces and Platforms

For a surprising number of businesses, a high-ranking website is just a nice-to-have. Their real business happens on specialized platforms where customers are already shopping, comparing, and buying. To find these competitors, you need to shift your mindset from keyword research to platform-specific reconnaissance.

Put yourself in your customer's shoes. Where do they really go to solve their problem? Their answer tells you exactly where to start digging.

- For E-commerce Brands: Don't just Google "organic dog treats." Head straight to Amazon, Etsy, or a niche marketplace like Chewy. Who are the top sellers? Who's running sponsored product ads? Dive into the reviews to see which brands have cultivated a loyal following right there on the platform.

- For B2B SaaS and Services: Your customers are living on review sites like G2, Capterra, and TrustRadius. Search for your category and dissect the comparison grids. You’ll uncover competitors you never knew existed, especially emerging players gaining steam through pure word-of-mouth.

This approach surfaces competitors whose entire business model is built around mastering a single ecosystem. They can be incredibly formidable opponents within that arena.

Leverage Social Media as an Intelligence Hub

Social media is more than just a place to post updates—it’s a dynamic, real-time map of your industry’s key players and conversations. People follow brands, influencers, and hashtags that align with their interests, creating a trail of digital breadcrumbs you can follow to uncover new competitors.

A great starting point is to identify the top influencers or thought leaders in your space. Their activity is a powerful signal of who and what matters in your niche.

A key tactic I always use is to analyze who key influencers follow and engage with. If a respected voice in your industry consistently interacts with a particular brand, that brand is almost certainly a relevant player you need to get on your radar.

This method is especially effective at revealing up-and-coming brands that haven't built much search authority yet but are quickly building social proof and momentum.

Deconstruct the Social Graph

You can get even more systematic. Each platform offers unique clues for finding rivals if you know where to look.

On LinkedIn, for instance: Go to a known competitor's company page and scroll down to find the "Pages people also viewed" section. This little box is a goldmine. LinkedIn’s algorithm is essentially handing you a curated list of similar companies based on actual user behavior. Click through a few of those suggestions, and you can map out an entire competitive cluster in minutes.

For Instagram and X (formerly Twitter): Here, it's all about hashtag analysis. Search for the core hashtags your target audience uses and see which brands consistently show up in top posts. This doesn't just identify active competitors; it shows you who is best at engaging your ideal customers on that specific platform. This simple process can help you unearth direct, indirect, and emerging players all at once.

Organizing Your Findings into an Actionable Matrix

You've done the legwork and unearthed a bunch of competitor websites. But right now, it’s probably just a chaotic list of domains. Raw data like this is just noise until you give it structure.

A simple list won't tell you who your biggest threats are, where the market gaps lie, or how your own value proposition stacks up. This is where building a competitor matrix comes in. It's how you turn a jumble of URLs into a powerful tool for making smarter decisions.

Defining Your Core Benchmarking Metrics

First things first, you need to decide what data points actually matter to your business. A good matrix goes way beyond just a name and a URL. It should capture the DNA of each competitor, letting you see the whole playing field at a glance.

For every competitor you've found, start by tracking these fundamentals:

- Value Proposition: What’s their core promise? In a single sentence, what problem do they solve, and who do they solve it for?

- Target Audience: Who are they talking to? Look for clues in their website copy, case studies, and ad campaigns. Are they targeting small businesses, enterprise B2B, or freelancers?

- Pricing & Model: How do they make money? Note their pricing tiers, whether it's a subscription, freemium model, or one-off purchases.

- Key Features or Products: What are the 3-5 standout offerings they push the hardest? This tells you where their strategic focus really lies.

When you track these same elements for every rival, you create a level playing field for analysis. You'll quickly spot patterns and see exactly who is chasing your customer with a similar offer.

A competitor matrix isn't just a spreadsheet you fill out once. It’s a living document that should inform your product roadmap, marketing messages, and sales strategy. It’s the bridge between raw intelligence and actionable insight.

The Power of Tiering Your Competitors

Not all competitors are created equal. Trying to keep tabs on a flat list of 50 companies is a recipe for overwhelm and wasted effort. I've found that the most effective way to manage this is to categorize them into tiers. This simple act brings immediate focus.

This tiering system transforms your messy list into a strategic map, showing you exactly where to direct your attention.

Tier 1: Direct Competitors

These are your head-to-head rivals. They solve the same problem for the same audience with a very similar solution. Your customers are almost certainly comparing you against them. You need to watch their every move.

Tier 2: Indirect Competitors

These companies solve the same problem but with a different type of solution, or maybe they target a slightly different customer segment. Think of a dedicated project management tool (your product) versus a sophisticated spreadsheet template. They're important because they can signal shifts in how customers are choosing to solve their problems.

Tier 3: Aspirational Competitors

These are the leaders in a broader space. You might not compete with them directly today, but their strategy, messaging, and tech are worth studying. They show you what "great" looks like and can inspire your own long-term goals.

Organizing your list this way helps you allocate your time and energy wisely—keeping a close eye on Tier 1, learning from Tier 3, and keeping Tier 2 on your radar. Finding and monitoring competitor websites effectively requires this kind of multi-dimensional tracking; it's so much more than simple domain discovery. Forward-thinking agencies are even running weekly audits to monitor competitor AI tool usage, analyze personalization tactics, and track new service launches to find their own blind spots. You can see how top agencies structure their competitor analysis and get ahead of the curve.

To help you hit the ground running, I've created a downloadable competitor benchmarking matrix. You can use it to plug in your findings and begin organizing them into this actionable, tiered framework today.

Answering Your Top Competitor Discovery Questions

Once you’ve gone through the different methods for digging up competitors, you're bound to have some practical questions. Let's be honest, the process of finding who you're really up against isn't always cut and dried, and tricky situations pop up all the time.

This section is your go-to for those specific "what if" scenarios. We'll tackle the most common questions that come up during a competitive intelligence project, from how often you should be looking for new rivals to what to do when your niche feels like a ghost town.

How Often Should I Search for New Competitor Websites?

One of the biggest mistakes I see is treating competitor discovery as a one-and-done task. Your market is a living, breathing thing. New players jump in, and established ones change direction. A static competitor list gets stale, fast.

The best approach is to blend periodic deep dives with continuous, lighter monitoring. I always recommend doing a full-blown competitor discovery sweep every quarter. This is when you go back through all the methods—from advanced search operators to SEO tool reports—to get a fresh map of the landscape and catch any significant new entrants.

But for your most important Tier 1 direct competitors, usually the top 3-5 companies, you need to be watching them much more closely. I suggest weekly check-ins on their websites. Keep an eye out for changes in messaging, new feature announcements, or shifts in their pricing.

A simple, low-effort way to stay on top of things is to set up Google Alerts for their brand names. This way, you get notified of major press releases or news coverage almost as it happens, ensuring you're never blindsided by a major strategic shift.

What Is the Best Way to Differentiate Direct and Indirect Competitors?

Getting the difference between direct and indirect competitors right is crucial for knowing where to focus your energy. If you get this wrong, you could end up obsessing over irrelevant companies while a rising indirect threat completely changes how your customers behave.

Here’s the framework I always come back to:

- Direct competitors solve the same problem for the same audience with a similar solution. Think of two project management SaaS tools, both targeting marketing agencies.

- Indirect competitors either solve the same problem with a different solution (like a project management tool vs. a complex spreadsheet template) or solve a different problem for the same audience.

The most effective way I've found to visualize this is with a simple two-by-two matrix. Label one axis "Audience" and the other "Solution." Plot your competitors on the grid. Anyone who lands in the same quadrant as you is a direct rival. This little exercise brings a ton of clarity to who you’re actually fighting for budget and attention.

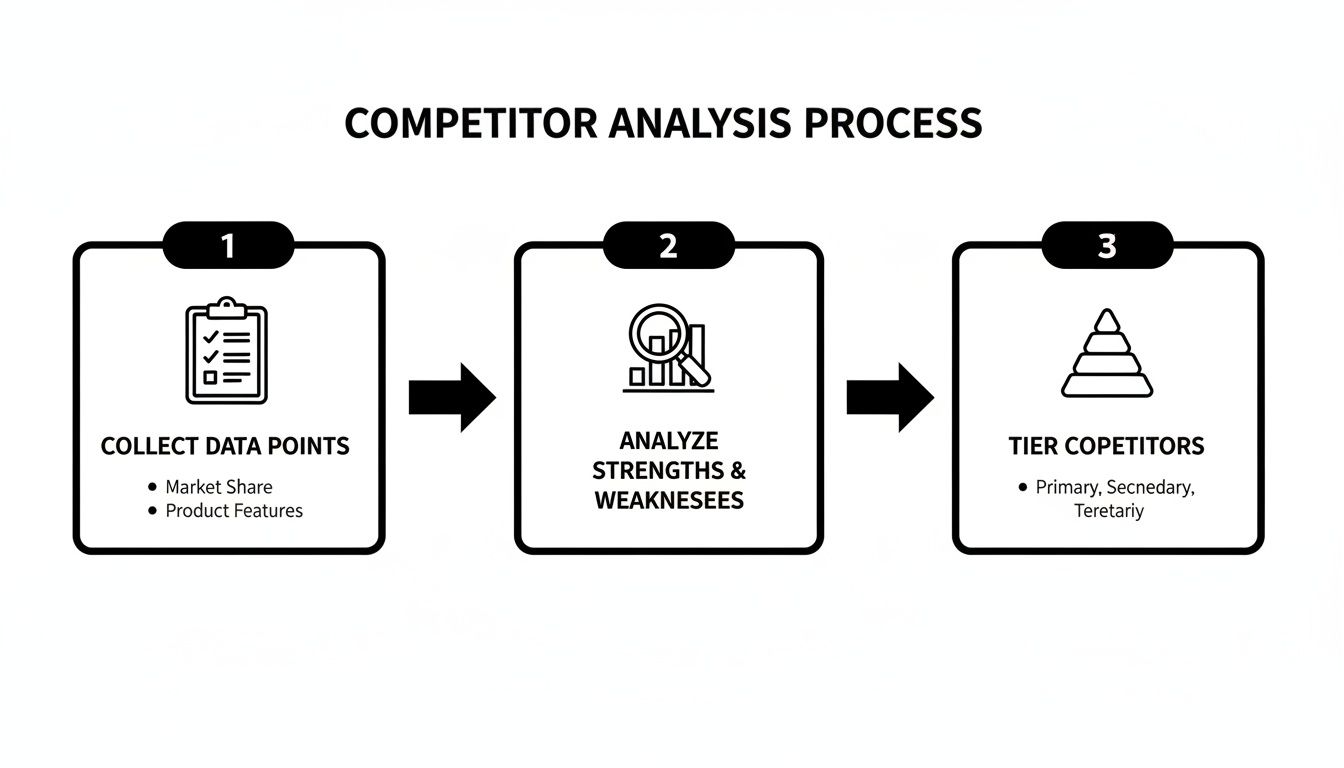

This infographic shows a simple, three-step workflow that moves from broad collection to focused, tiered analysis.

This process really underscores that finding competitors is just the starting line; the real strategic value comes from analyzing and tiering them properly.

What if I Cannot Find Any Competitors in My Niche Industry?

Coming up empty in your search can be both thrilling and a little terrifying. If your online tools and search queries aren't turning up anything, it's time to switch from digital spying to some old-school investigation.

First, think laterally. Go look at the exhibitor and sponsor lists from major industry trade shows and conferences, both past and future. These are absolute goldmines for finding companies that might not have a strong digital footprint but are major players within the industry itself.

Next, broaden your search. Dig into patent and trademark databases. Searching for filings related to your core technology can unearth companies that are still in stealth mode or B2B players who aren't very visible to the public.

Most importantly, you have to talk to your potential customers. This is non-negotiable. Ask them, "Before you found us, what were you using to solve this problem?" Their answers will reveal the non-obvious alternatives—the homegrown solutions, adjacent tools, or manual processes they've been relying on. A lack of direct online competition could mean you've found a huge, untapped market, but you have to validate that the need is real first.

Are There Any Free Tools for Finding Competitor Websites?

Absolutely. While paid tools offer more depth and efficiency, you can get a surprisingly long way without spending a dime. By cleverly combining a few free resources, you can build a solid picture of your competitive environment.

Here are some of the most powerful free options out there:

- Google: Armed with advanced search operators like

related:domain.com, Google itself is your most valuable free tool. - Google Alerts: As I mentioned, it's essential for monitoring known competitors and industry keywords without any cost.

- Social Media Ad Libraries: The ad libraries for Meta (Facebook/Instagram) and TikTok are completely free to browse. You can search by keyword and see exactly who is running ads, what they're saying, and where they're sending traffic.

- Review Platforms: Sites like G2 and Capterra offer free access to their category listings. You can explore your software or service category and find comprehensive lists of players, complete with user reviews and feature comparisons.

These free methods give you an excellent foundation. If you want a quick and affordable market snapshot to get your research started, a tool like StatsHub.ai can deliver a structured report with key players for a small, one-time fee. It’s a great way to get a massive head start.

Tired of spending days on manual research? StatsHub.ai delivers a comprehensive market report—including key competitors, market size, and growth trends—in minutes for just $15. Get the credible data you need to make confident decisions, fast. Get your instant market report from StatsHub.ai today.

Ready to move faster?

Generate a market report in minutes, not weeks.

$15, easy to share, and ready for your team.